43+ debt to income ratio for mortgage approval

Many lenders may even want to see a DTI thats closer to. You pay 1900 a month for your rent or mortgage 400 for your car loan.

Everything You Need To Know About The Pre Approval Process

Use a DSCR loan to purchase investment property without using personal income to qualify.

. Web The debt-to-income ratio in mortgage loans is the same measure used in personal loan products. Apply Get Pre-Qualified in 3 Min. Your total monthly debts are 1800.

Ad Best Mortgage Pre-Approval in California. Ad See how much house you can afford. Web Here are debt-to-income requirements by loan type.

Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. There are two ratios a front ratio which consists of your proposed housing.

Use a DSCR loan to purchase investment property without using personal income to qualify. Web Results are based on a debt-to-income ratio of 43. Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage.

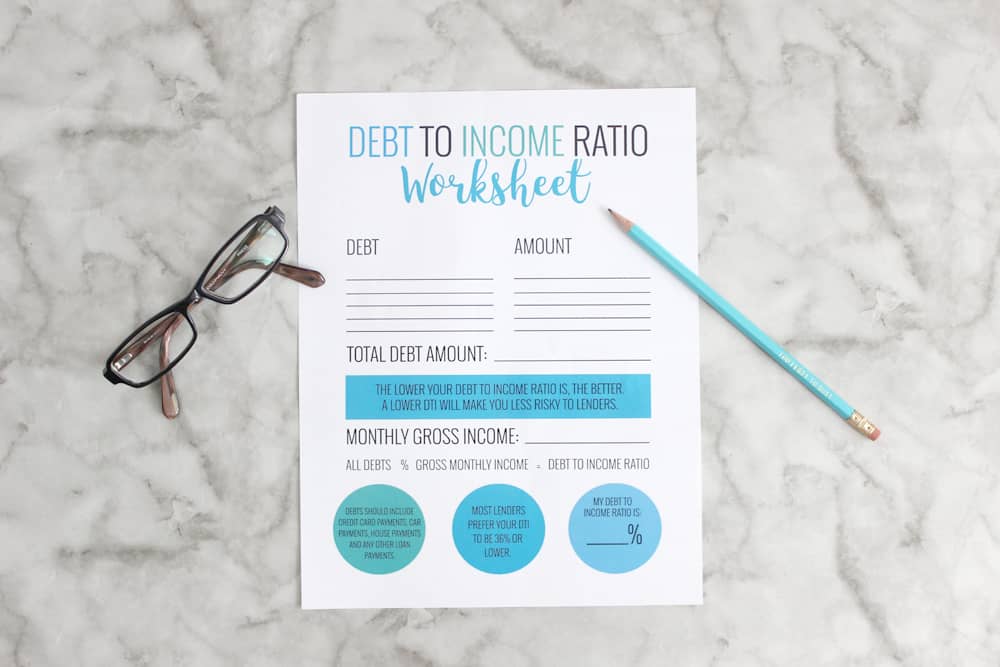

Web Debt-to-income ratio your monthly debt payments divided by your gross monthly income. Web Debt to income ratios are just what they sound like a ratio or comparison of your income to debt. Get Instantly Matched With Your Ideal Mortgage Lender.

Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Ad NASB is a Debt Service Coverage Ratio mortgage lender.

Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Compare Mortgage Lenders And Find Out Which One Suits You Best. Lock In Your Rate With Award-Winning Quicken Loans.

Estimate your monthly mortgage payment. Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad NASB is a Debt Service Coverage Ratio mortgage lender. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA.

Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Youll usually need a back-end DTI ratio of 43 or less. Ad Compare Home Financing Options Online Get Quotes.

If your home is highly energy-efficient. Trusted VA Loan Lender of 300000 Veterans Nationwide. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Experts say you want to aim for a DTI of about 43 or less. A DTI of 43 is typically the highest. Compare Now Find The Lowest Rate.

Web And you have a rent payment of 1200 a car payment of 400 per month along with a minimum credit card payment of 200. Lenders generally also look for a debt-to-income ratio of 36.

Need A Mortgage Keep Debt Levels In Check The New York Times

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

What Debt To Income Ratio Is Needed For A Mortgage Tally

Maximum Debt To Income Ratio For A Fha Mortgage Mortgage Info

What S A Good Debt To Income Ratio For A Mortgage

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

Debt To Income Ratio And Mortgage Approvals Bmo

Debt To Income Ratio And Mortgage Approvals Bmo

Debt To Income Ratio And Mortgage Approvals Bmo

Calculating Your Debt To Income Ratio

.png?width=600&name=understanding-debt-to-income-ratio-(new).png)

Calculating Your Debt To Income Ratio

What Debt To Income Ratio Is Needed For A Mortgage Tally

Debt To Income Ratio Calculator What Is My Dti Zillow

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Applying For A Mortgage Here S What Your Debt To Income Ratio Should Be

Debt To Income Ratio What Is A Good Dti For A Mortgage

Debt To Income Ratio Dti What It Is And How To Calculate It